For risk-aware investors looking to participate in the US equity market for both income and total return, quality dividend payers are a compelling route. Comparing the constituents of the Morningstar US Dividend Opportunity Index to the Morningstar US Market Index, a broad gauge of US equities, helps tell the story.

The Dividend Opportunity Index includes shares of dividend-paying companies with durable competitive advantages in the eyes of Morningstar Equity Research, as well as strong growth and high-quality characteristics. The dividend index’s sectoral composition varies significantly from a US equity market comprised of nearly 43% in the technology and communications services sectors and the two largest holdings, NVIDIA (NVDA) and Microsoft (MSFT), representing nearly 13% as of August 29.

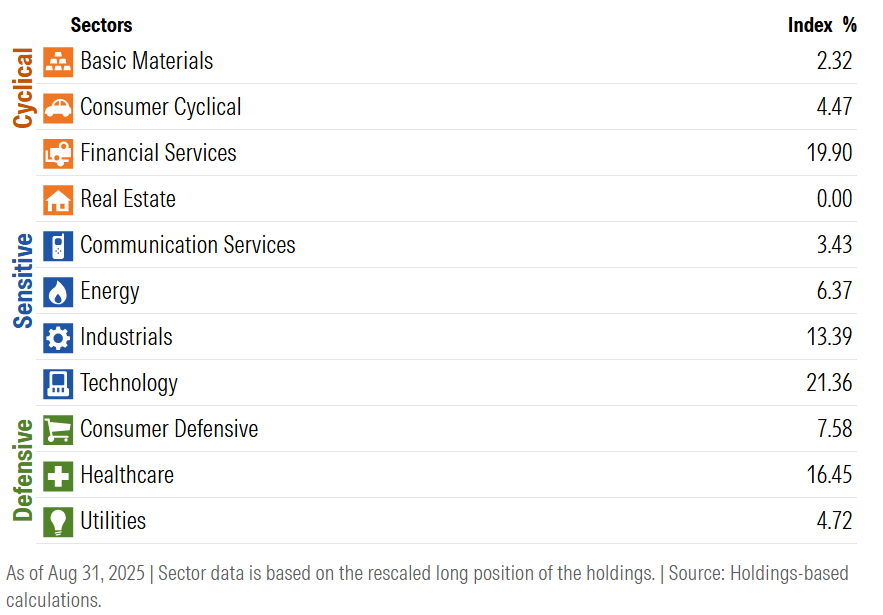

The US Dividend Opportunity Index currently devotes more weight to the energy, financials, industrials, and healthcare sectors. The index is also underweight tech and less top-heavy than the broad market. The index underpins the recently introduced Franklin U.S. Quality Moat Dividend ETF (FDIV) from Franklin Templeton Canada.

The US Equity Market Through a Quality Dividend Lens

Dan Lefkovitz, Index Strategist, Morningstar Indexes, said:

“Dividend-paying stocks are a great way to invest for both income and capital appreciation, but it’s important to manage the risk of yield traps. Adding a quality screen through Morningstar’s Moat rating can help investors find competitively advantaged companies with sustainable, even growing, dividends.”

Ahmed Farooq, SVP, Head of Retail ETF Distribution, Global ETFs, Franklin Templeton Canada, said:

“As part of the index underlying FDIV, our new ETF, Morningstar’s Moat rating allows us to filter dividend-paying companies with durable competitive advantages. Using Moat, FDIV takes a holistic view of the company, combining dividends and quality or a solid total return approach.”

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.

Commissions, management fees, brokerage fees and expenses may be associated with investments in ETFs. Please read the prospectus and ETF facts before investing. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will reduce returns. For more information on any Franklin Templeton funds, contact your financial advisor or download a free prospectus. Investors should carefully consider a fund's investment goals, risks, sales charges and expenses before investing. The prospectus contains this and other information. Please read the prospectus carefully before investing or sending money.

The Franklin U.S. Quality Moat Dividend Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to the owners of the Fund or any member of the public regarding the advisability of investing in index-based ETFs generally or in the Fund in particular or the ability of the Morningstar® US Dividend Opportunity Index to track general market performance. THE MORNINGSTAR ENTITIES EXPRESSLY DISCLAIM ANY WARRANTY AROUND THE ACCURACY, COMPLETENESS AND/OR TIMELINESS OF THE FUND OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN.